Whether a recent plumbing or electrical issue has forced you to consider making some upgrades, or you want to upgrade your wiring or water heater to improve your home's energy efficiency, there's now a way to make the process more affordable. The Inflation Reduction Act, or the IRA, provides rebates and tax credits for various plumbing and electrical services.

Saving on Electric Services

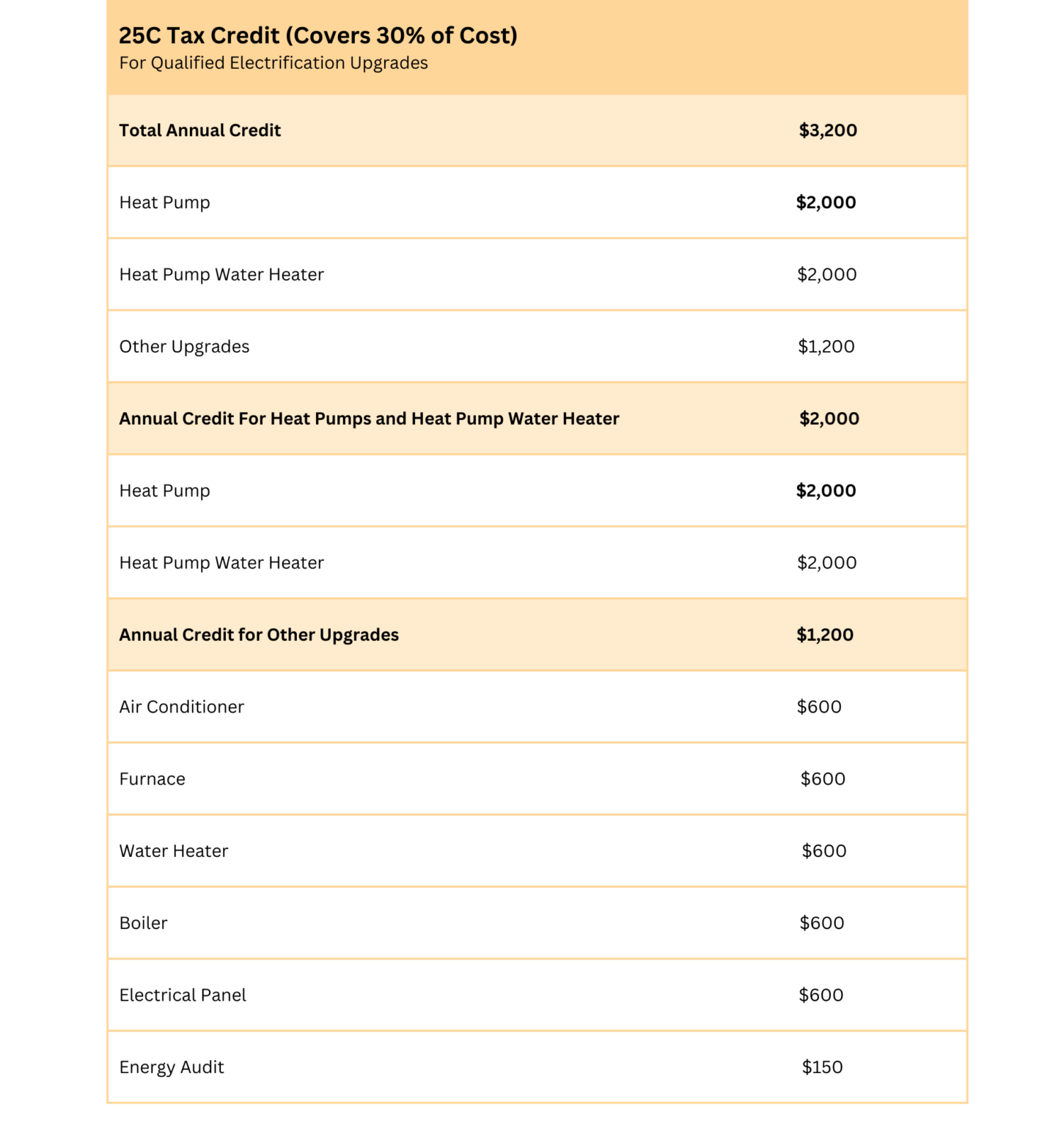

The IRA incentivizes homeowners with IRA tax credits and rebates for electric services, including rewiring with new electrical panels or home updates. Homes over 25 with original wiring are often at risk of electrical and safety issues. Excessive wear on old wiring can lead to overheating and short circuits, which can cause multiple issues in the home and be a safety hazard. Upgrading to a new panel can save up to $600 with IRA tax credits.

If your older home still has its original wiring or has panel-related electrical issues, it may be time to upgrade to a new panel to ensure that your modern appliances receive the electricity they need without overtaxing your system. This upgrade will give you confidence that you're protecting your home. With the help of a qualified electrician, you can replace your electric panel, receive IRA tax credits for doing so, and improve the efficiency and safety of your home.

Saving on Plumbing Services

One of the biggest issues with inefficient water heaters is that they require more energy to heat water and can increase your energy and water bills. With the IRA, you can save up to $600 on installing a new, more energy-efficient water heater. If you install a heat pump water heater, you can receive up to $2000 in tax credits.

Even if your current water heater works, it could cost you higher monthly energy bills. Older, outdated models require more energy to perform the same job as a newer and more efficient model. By upgrading your water heater or switching to a heat pump water heater, you can make your home more environmentally friendly, which will also benefit you in lower energy bills.

Saving More Money With the HOMES and HEEHRA Rebates

Not only can you save money on plumbing and electrical upgrades, but you may qualify for the IRA's HOMES or HEEHRA rebates. The HOMES rebate provides savings of up to $8,000 when you reduce your home's energy use by 35%. Homeowners can save up to $14,000 with the HEEHRA rebate based on income eligibility and how they improve the overall energy efficiency of their homes.

If you need to upgrade the electrical or plumbing in your home, there's no better time than the present. With all the benefits of the IRA, you can save money, make your home more efficient, and do your part to support the environment. Contact us today at Blaze Air to learn more about how we can help you benefit from the IRA with quality electrical and plumbing services.

*Disclaimer: "Brand Name" does not guarantee the availability of tax credits or rebate funds, nor the specific rebate or credit amounts that may be available to each individual. Rebates and tax credits are subject to change and may vary depending on factors such as geographic location, income level, and the specific details of the heating and cooling system being installed. In addition, please note that the information provided by "brand name" regarding tax credits is for general informational purposes only and should not be considered tax advice. Homeowners should consult with a qualified tax advisor to determine their eligibility for tax credits and to receive specific advice on their individual tax situation. "Brand Name" is not responsible for any errors or omissions in the information provided, and we make no guarantees or warranties regarding the availability or applicability of any tax credits or rebates.